Would NFC smartphones have helped at Target?

Recent massive data breaches at Target and Neiman Marcus have re-ignited a campaign by retailers to get U.S. consumers to carry "PIN and chip" credit and debit cards to replace the decades-old magnetic stripe cards used by 90% of Americans.

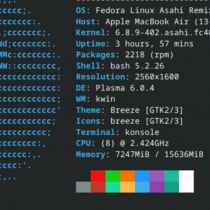

Such PIN and chip cards would do what dozens of newer-model smartphones with NFC chips are already doing while using payment apps like Google Wallet and Isis. So why isn't the focus on promoting near-field communication smartphones instead of PIN and chip cards?

The answer is complicated and political, primarily because there are questions over who is liable for a data breach -- the retailers or the financial institutions and their associated card processing companies such as Visa and MasterCard. It is also expensive to install point-of-sale (POS) terminals in millions of retail locations and at ATMs that can read chips on the newer contactless cards, as well an NFC signal from a smartphone.