How banks fight hackers and fraudsters

It was 3am when 21-year-old Sydney secretary Rhiannon Moore got the SMS from Westpac. Her debit card had been blocked after the bank saw it had been used to buy porn and air tickets to Malaysia.

"They were obviously onto it straight away. I don't know how they found out about it so quickly," she said.

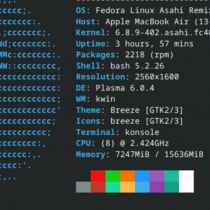

Westpac's Head of Financial Crime Management, Rob Love, said dodgy transactions are detected using a combination of purchased software, in-house tech and human checkers. "We are monitoring all transactions as they occur 24/7 and run them against a series of rule sets that look to predict the likelihood of a transaction being fraudulent," he said. Suspicious transfers are checked by staff that contact the customer or organise for the card to be cancelled quickly if big sums of money are involved.