Crypto payments above $10,000 would be reported to IRS under Treasury plan

The Biden administration wants businesses to report cryptocurrency transactions with values of at least $10,000 to the Internal Revenue Service.

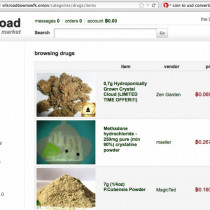

"Cryptocurrency already poses a significant detection problem by facilitating illegal activity broadly including tax evasion," the US Treasury Department said in its proposal for implementing the tax compliance initiatives in President Biden's American Families Plan. The larger Biden plan still needs approval from Congress.

The Treasury document said that crypto reporting is one part of "the President's tax compliance initiatives that seek to close the 'tax gap'—the difference between taxes owed to the government and actually paid." The proposal calls for a $4.5 billion investment in IT to implement a new information-reporting regime that would help close that gap, which was nearly $600 billion in 2019.