Banks weigh up biometrics

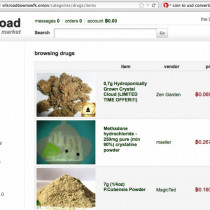

Companies could soon have to use biometric technology to authorise major financial transactions, as part of banking industry measures to tackle internet fraud and money laundering.

Industry body the Association for Payment Clearing Services (Apacs) says corporate customers will be among the first to receive devices to physically confirm signatories as well as using passwords, so-called two-factor authentication (Computing, 14 April).

But banks dealing with high-value electronic transactions will require more advanced security, possibly via a third means of authentication such as fingerprint or retina scanning, says Tom Salmond, a consultant for Apacs' ecommerce group.

'If you have multiple signatories on an account it's quite difficult to authenticate all of them, outside of giving them all different passwords,' said Salmond.