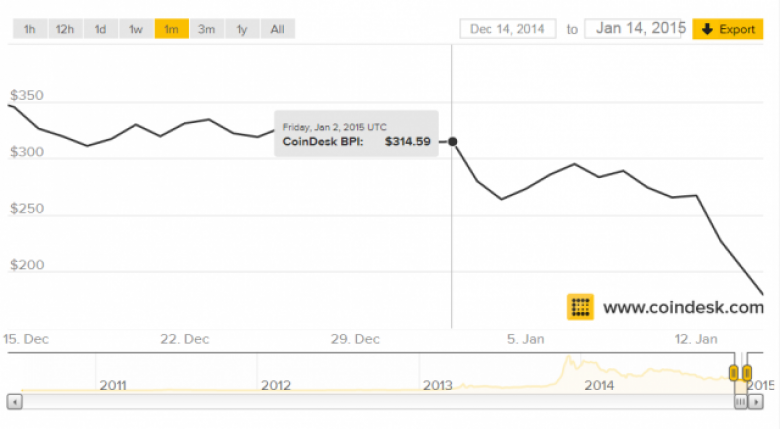

Bitcoin price plummets as investors flee the currency

Bitcoin prices have been taking a beating since the new year, but today the bottom fell out of the market altogether. After debuting at $314.59 on Friday, January 2, the currency fell to $267 by Monday, Jan 12. Then, in the past 36 hours, prices fell completely off a cliff, with the currency currently priced at $178.67 at CoinDesk.

Currently, there’s no explanation for the enormous price drop over this short period of time, but the ripple effects are already hitting miners. Mining hash rates dropped precipitously initially, and while they’ve since risen again, they’re still well below early January rates. The problem, for Bitcoin, is simple: there are prices at which the majority of mining operations are not possible.

In the beginning, it was GPUs that drastically increased BTC mining capability and kept the operation profitable, followed by FPGA and ASICS. As more and more people bought ASIC miners, operations began to shift further, from private residential complexes to huge cloud networks. These large-scale mining operations managed to further reduce costs by centralizing operations and paying lower utility rates.